Table of Content

They do this because they are in the business of originating loans. These companies couldn’t care less whether you pay your loan. Dave Ramsey argues that “a monkey could assign you a loan” using the methods these companies use.

The booming housing market is finally starting to slow down, as skyrocketing home prices, high mortgage rates and a lack of inventory are causing demand to decline. But even as prices start cooling down after a year of double-digit price gains, the market is still extremely overvalued. For aspiring first-time homebuyers, this is a hard time to purchase a home, especially as mortgage rates are now much higher than they were last year or even two years ago. Many homebuyers have been squeezed out of the market as a result of unaffordable prices and surging mortgage rates, which have in turn caused demand—and sales—to drop. "We have marked down our expectations for price declines," Moody's Analytics chief economist Mark Zandi told Newsweek.

Look To Rents

Through the first quarter of 2022, national house prices are "overvalued" by 24.7%. That's up from the fourth quarter of last year, when Moody’s Analytics determined national house prices were "overvalued" by 20.9%. While CoreLogic and Moody's Analytics agree the housing market is overvalued, CoreLogic isn't quite as bearish. The real estate research firm says only 3% of housing markets have an "elevated" or "high" chance of seeing home price declines over the coming year. Nationally, CoreLogic expects home price growth to jump another 5% over the coming 12 months. That would mark a deceleration from the latest 12-month home price jump (19.8%), however, it'd hardly be the relief home shoppers seek.

Mark Zandi, the chief economist at Moody’s Analytics, explains why homes in so many cities across the U.S. are overvalued and how long this could last. Yes, home prices are overvalued, but you don’t have to make the same mistake as people in the early 2000’s. Right now, the pendulum has swung so far to one side as home prices are overvalued.

Will these overvalued housing markets cool off?

Atlanta, meanwhile, jumped from 10th place to fifth, with a 7% increase in housing price premiums. You need to be patient and find the 1/500 that makes the numbers work. The added equity by paying down the mortgage is known at the time the mortgage is originated. Then, you can compare the intrinsic value to the reflected market price to see whether it is undervalued or overvalued.

"We previously expected flat national house prices , now we expect them to be down as much as 5 percent." Data provided to FOX Television Stations by Moody’s Analytics shows homes in 97% of U.S. metro areas are overpriced, with the most overvalued markets seeing homes priced at 50% to 70% more than they’re worth. This overvaluation is compared to the historical norms of local household incomes, rents, and construction costs. The economist said a given housing market is considered overvalued if property costs in the area are "well above" the historical relationship between home prices and incomes, rents and construction costs. Zandi forecasts that in overvalued markets like Boise and Phoenix, home prices could drop by 5 to 10 percent over the coming year.

Your Money or Your Life

The scary thing is people are making this exact same mistake! For the next several months, housing economists tell Fortune we should expect further slowing. That's fueling an interest in buying because purchasers can at least lock in a stable monthly mortgage payment, even if they'll be paying more than a year ago, Tucker noted. Cities in the South and Mountain West, which have seen an influx of buyers during the pandemic, could suffer a 10% drop in housing prices during the next several years, Zandi predicted.

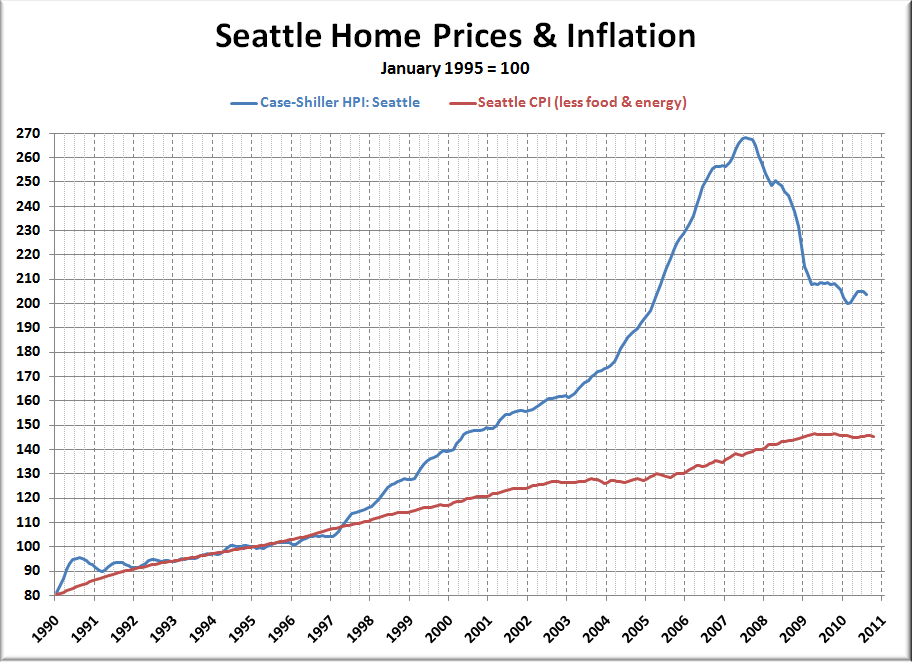

If you look back over the last 40 years or so , you’ll find that home prices in the U.S. tend to rise by around 4% annually. That’s well below the 13.2% annual increase reported by Zillow. During the last housing bubble, many metro areas experienced a surge in new home construction. This was largely fueled by speculation, along with ridiculously lax mortgage-lending standards.

Mark Zandi, the chief economist at Moody’s Analytics, noted how many of these markets were "juiced up" because of previously low mortgage rates and the implementation of remote work during the COVID-19 pandemic. The American home real estate market is saturated with demand. This means home prices are overvalued, and it is a stark reminder of the recent real estate crash. Among the markets analyzed by Moody’s Analytics, 183 are "overvalued" by more than 25%. That's up from 150 regional housing markets it deemed "overvalued" by more than 25% in the fourth quarter of 2021.

Additionally, banks kept these mortgages on their balance sheets. This meant they had a vested interest in the mortgage being paid off. When my parents and grandparents bought their homes, they actually had to go to a bank.

Simply being overvalued doesn’t guarantee that home prices will decline. Historically speaking, when a housing market “rolls over,” it’s significantly overvalued markets that are at highest risk for price declines. Heading forward, Moody’s Analytics expects the 183 markets overvalued by more than 25% to see home prices decline by -10% to -15%. If a recession hits, Moody’s Analytics expects those 183 significantly overvalued regional housing markets to decline by -15% to -20%. While Zandi doesn’t predict national home price declines, he estimates significantly "overvalued" housing markets, places like Boise and Charlotte, could see 5% to 10% home price declines over the next 12 months.

Arizona and Texas were also reported to have overvalued home prices, both by 15% – 19%. Over the coming year, theMortgage Bankers Association,Fannie Mae,Freddie Mac,CoreLogic, andZillowall predict a low single-digit rise in home prices. Zandi noted how the median home price in the U.S. has hovered around $400,000. For someone putting 20% down at the current mortgage rate, "you’re paying $500 more a month now than you would have a year ago for the median-priced home with 20% down at that mortgage rate."

According to a recent report, home prices across the United States are overvalued in many parts of the country. That report came from the credit rating agency Fitch Ratings. "There are a lot of stark differences with the mid-2000s," he said. "For one thing, rents are rising very rapidly, and the credit of all the recent homebuyers is really strong." That new property listings under $700,000 generate frenzies, with often more than a dozen offers within 24 hours. "The biggest surprise is how sharply home sales have declined. Both new and existing home sales have fallen very, very sharply," he said.

No comments:

Post a Comment